If Risk Makes You Slip, We Become the Rung That Helps You Rise

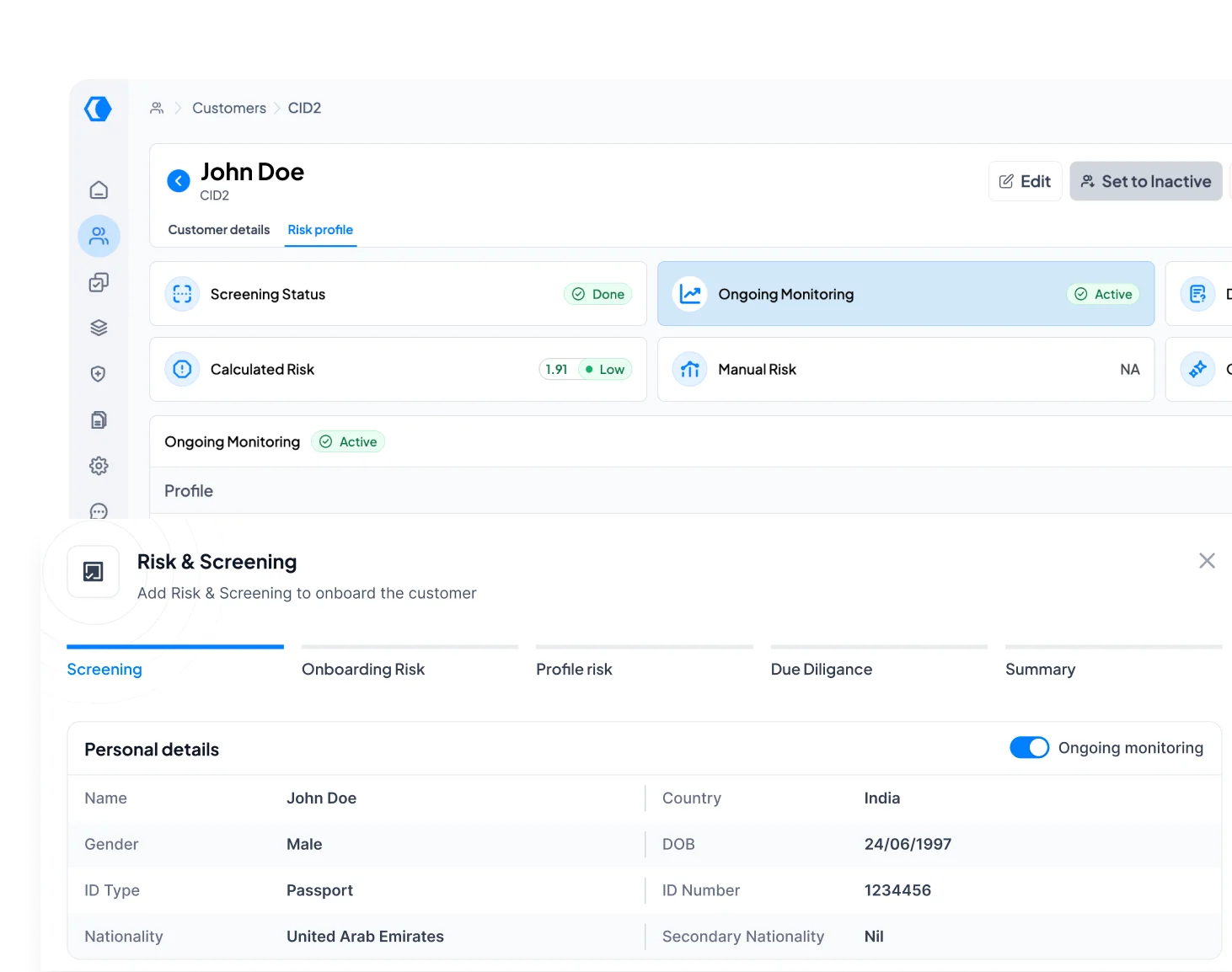

The foremost and important step in risk assessment is first identifying the ML/FT and PF risks. Citadel365 identifies risk right after the minimum mandatory KYC details are entered in the system via:

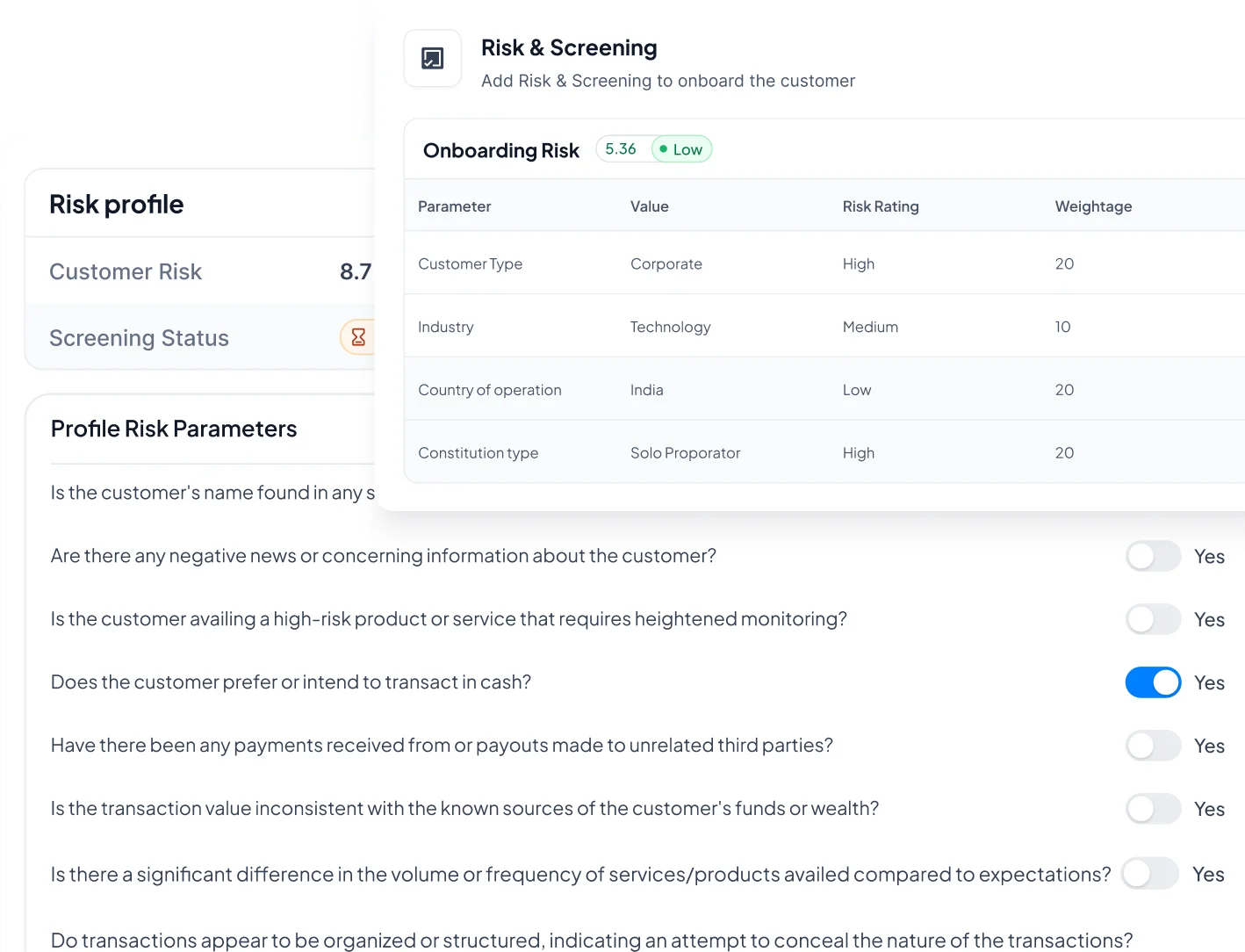

The system automatically calculates the onboarding risk using parameters like customer type, nationality, occupation, residence status, etc.

Screening outcomes from KYC6, including PEP (tier 1, 2 & 3), adverse media, and sanctions feed directly into the customer’s profile risk.

Citadel365 evaluates the threat level of an organisation using two methods: onboarding and profile risk. These layers offer a more accurate and risk-aligned picture than single-layer scoring models.

Based on this, the consolidated risk is the weighted average of onboarding and profile risk, giving a single, audit-friendly final risk score. Wherein the weights can be customisable.

Risk assessment isn’t a one-time job. One needs to be agile to counter financial crimes. Citadel365 ensures continuous monitoring through various aspects:

Light the Corner Where Risk Likes to Hide

Citadel365 Checks for Hidden Spots and Cracks in Your AML/CFT Compliance Walls

The right features today prevent the wrong risks tomorrow. Here’s what Citadel365 offers.

Metrics That Bend to the Context

Citadel365 gives complete flexibility to customise scores, ratings and weightages. Override risk levels as needed, giving you control over risk management without compromising the scoring logic or the average.

Risk, Calculated Twice for a Reason

A Place Where Risk Comes into Focus

Letting Automation Carry the Weight

Always Current. Never Assumed

With the integrated screening via KYC 6, customers are re-screened daily, and Citadel365 updates screening results automatically, ensuring accuracy and compliance.

Raise a question, and Citadel365 delivers intelligence that drives results and benefits that matter:

A Pattern We See

Manual calculation makes risk assessment slow and inconsistent.

With Citadel365, you can rely on automated risk calculations and daily re-screening updates, reducing repetitive work and bringing consistency to routine risk evaluation.

Compliance gaps appearing between reviews.

With Citadel365’s daily re-screening at the end of the day and updated data via KYC6, nothing slips past your team, reducing compliance blind spots.

A static risk model applied to dynamic customers

Citadel365 is a system that adapts to your needs and lets you configure risk metrics, scores, and weightage without affecting the overall risk average, giving users complete control.

Risk scores tend to lose their meaning.

Citadel365 ensures every risk score is calculated, weighted, and changes are logged, tracked, and displayed in the risk profile tab whenever information is updated.

When the Waters Rise, Rise Higher

Citadel365 Equips You with the Customer Risk Assessment Software to Stay Firmly in Control

Citadel365 requires basic KYC details such as identity information, licenses, ownership records, and supporting documents, which enable the system to initiate screening and generate risk.

Risks in Citadel365 are prioritised using a weighted risk score combining Onboarding Risk and Profile Risk. This prioritisation logic surfaces high-risk customers to the top of the queue, optimising compliance review workflows.

Citadel365 identifies and evaluates risks through automated screening against global sanctions, PEP, and adverse media lists via integrated KYC intelligence and consolidates these factors into a weighted overall risk profile.

Citadel365 offers automated risk scoring, consistent and standardised assessments, real-time recalculations during onboarding with daily re-screening, configurable risk metrics and weighting, and transparent, audit-ready scoring, reducing compliance gaps and ensuring scalability.

Citadel365 ensures continuous monitoring with daily re-screening to detect new Sanctions, Adverse Media, or PEP and automatically adjusts the customer’s risk score. If it crosses your risk threshold, the system immediately flags the case for review and triggers EDD actions.