Ready to Defeat Your AML Compliance Obstacles?

Citadel Brings Revolution with Secure Solutions to AML Compliance Problems

Summary

In the realm of Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance, screening is the foundation for identifying and mitigating risks associated with financial crimes. With regulatory expectations growing stricter and more stringent and financial crimes becoming increasingly sophisticated, institutions must adopt effective and trustworthy software to ensure compliance. A robust screening software solution is vital, as it not only enhances operational efficiency but also reduces risks, minimizes costs, and protects an institution’s reputation.

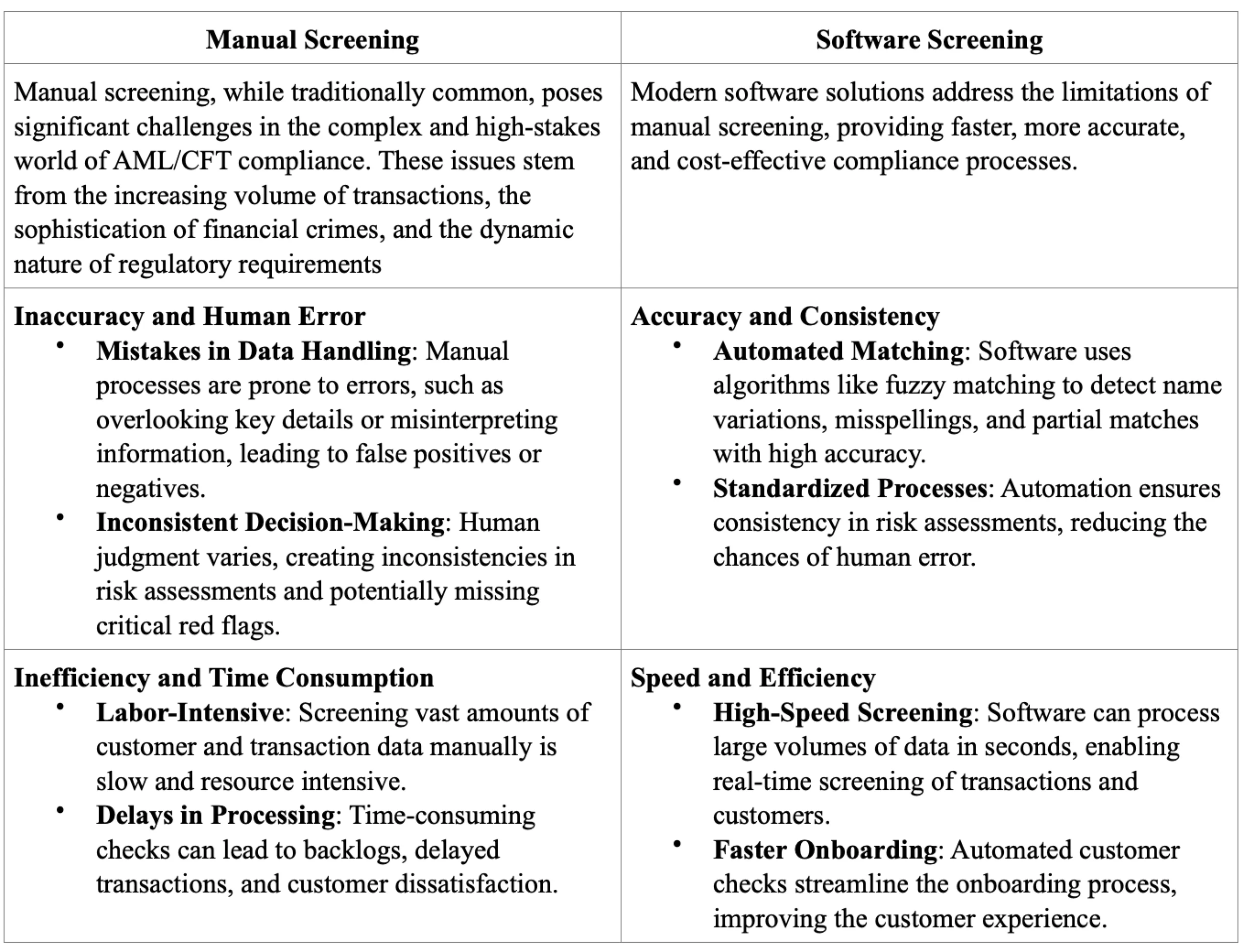

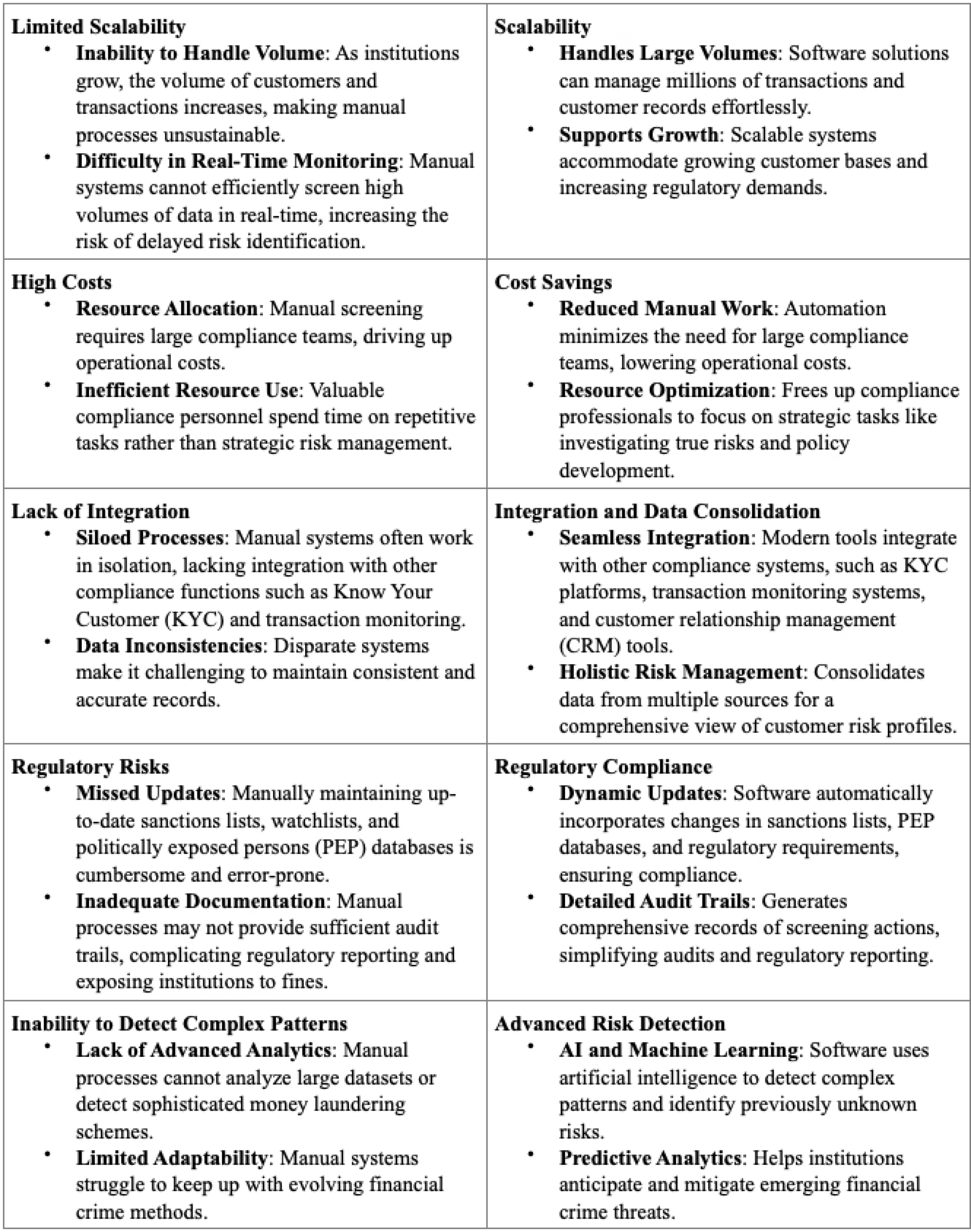

To save money or the effort of looking for a compliance software that will help in screening, various companies resort to manual screening which can be harmful in many ways. The differences between the obsolete manual screening and the new-age software screening are:

Hence, manual screening is inefficient, error-prone, and unsustainable in today’s fast-paced financial landscape. On the other hand, software solutions bring speed, accuracy, and scalability, making them mandatory and unavoidable for AML/CFT compliance. By automating processes, integrating data, and leveraging advanced technologies like AI and machine learning, software significantly reduces operational burdens, improves risk detection, and ensures regulatory compliance.

Selecting the right software for screening in Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance is a critical decision for institutions. It impacts the effectiveness, efficiency, and reliability of an organization’s efforts to detect and mitigate financial crime risks. Choosing the wrong software can lead to operational inefficiencies, regulatory penalties, and reputational damage, while the right solution enhances compliance, reduces costs, and protects against emerging threats. This article highlights the importance of choosing the correct software for screening and the factors that make this decision vital.

Ensuring Compliance with Regulations

AML/CFT regulations are stringent and constantly evolving, with global organizations like the Financial Action Task Force (FATF), Office of Foreign Assets Control (OFAC), and regional regulators setting high standards for compliance. The correct software ensures adherence to these regulations by:

Software that fails to meet regulatory standards can expose institutions to significant fines, legal action, and reputational harm.

Improving Screening Accuracy

Effective AML/CFT screening requires a balance between detecting true risks and avoiding unnecessary alerts. The right software achieves this balance through:

Choosing subpar software increases the risk of missing true matches (false negatives) or overwhelming teams with irrelevant alerts (false positives).

Scalability and Performance

As businesses grow, their customer bases and transaction volumes expand, requiring scalable solutions. The correct software can handle:

Real-Time Risk Mitigation

Financial crimes like money laundering and terrorism financing occur in real time, making timely detection essential. The correct software:

Using outdated or inefficient software may delay risk detection, allowing illicit activities to go unnoticed and increasing institutional vulnerability.

Adapting to Emerging Threats

Financial crime tactics are constantly evolving. The correct software adapts to these changes by:

Integration with Other Systems

AML/CFT compliance involves various interconnected processes, such as customer onboarding, transaction monitoring, and risk assessment. The correct software:

Regulatory Reporting and Audit Preparedness

Regulators often require detailed reports and audits to ensure compliance. The correct software simplifies this by:

Reputation and Customer Trust

Non-compliance with AML/CFT regulations or association with financial crimes can damage an institution’s reputation irreparably. The right software:

Support and Vendor Reliability

The reliability of the software vendor is as important as the software itself. Choosing a solution from a trusted vendor ensures:

Selecting unreliable software or vendors can lead to frequent downtime, limited support, and outdated features.

Choosing the correct software for AML/CFT screening is not merely a technical decision but a strategic one that affects an institution’s ability to comply with regulations, manage risks, and operate efficiently. The right software ensures accurate and timely risk detection, reduces operational costs, and adapts to evolving threats, ultimately safeguarding the institution’s reputation and financial stability.

Arjun is the Co-founder and CEO of Citadel, where he leads the company’s vision across technology, business, and regulations. He brings over a decade of experience in building and scaling technology ventures. Arjun holds a B.Tech. in Information Technology and a Master’s in Management, supported by his certification as a Financial Crime Specialist, an uncommon combination that allows him to balance innovation with regulatory requirements.

Having advised leading banks and financial institutions on digital solutions and compliance technology, Citadel continues to grow with an ambition.