Onboard customers, submit regulatory reports, and automate AML compliance with Citadel365.

Citadel365 opens a new gateway to age-old compliance problems. We automate your AML compliance processes so that the compliance teams can rest easy.

We are the pathmakers. Citadel365 takes pride in easing compliance with AML/CFT regulatory requirements. Whether you are dealing with high false positives or struggling with time-consuming onboarding processes, we root out the stumbling blocks.

Citadel365 is a dynamic engine to streamline AML/CFT compliance. With our tailor-made approaches, we serve you at every level of compliance processes to accelerate your interactions with your customers.

Drained with Filling Customer Information Manually?

Citadel365 Automates KYC Processes, Reducing Manual Effort

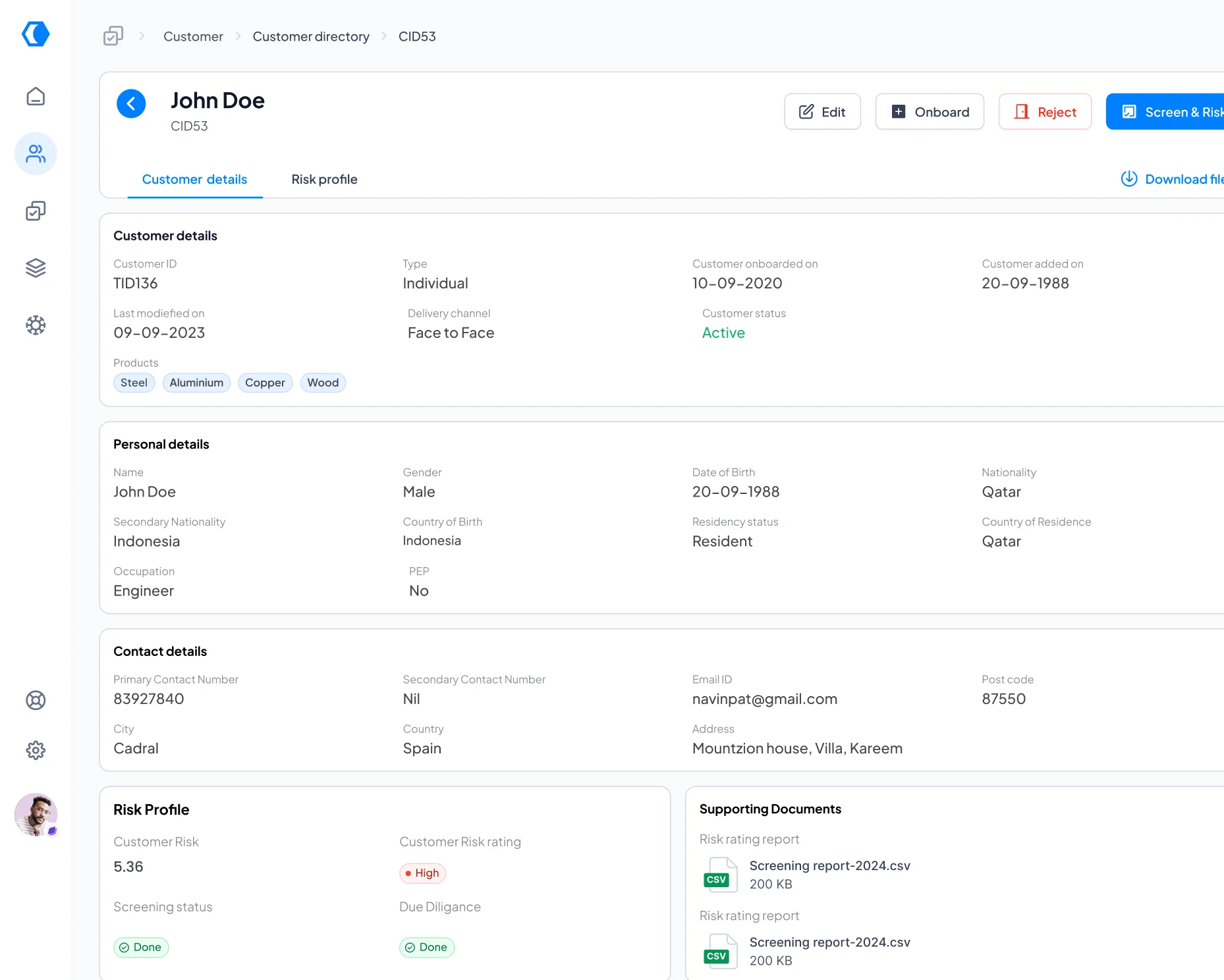

Capture customer data through multiple channels, including KYC self-service.

Initiate the onboarding process with the required information.

Attach and manage multiple supporting documents across formats.

Track expiring documents and ensure up-to-date client information.

Extract customers’ details directly in the form of Excel reports.

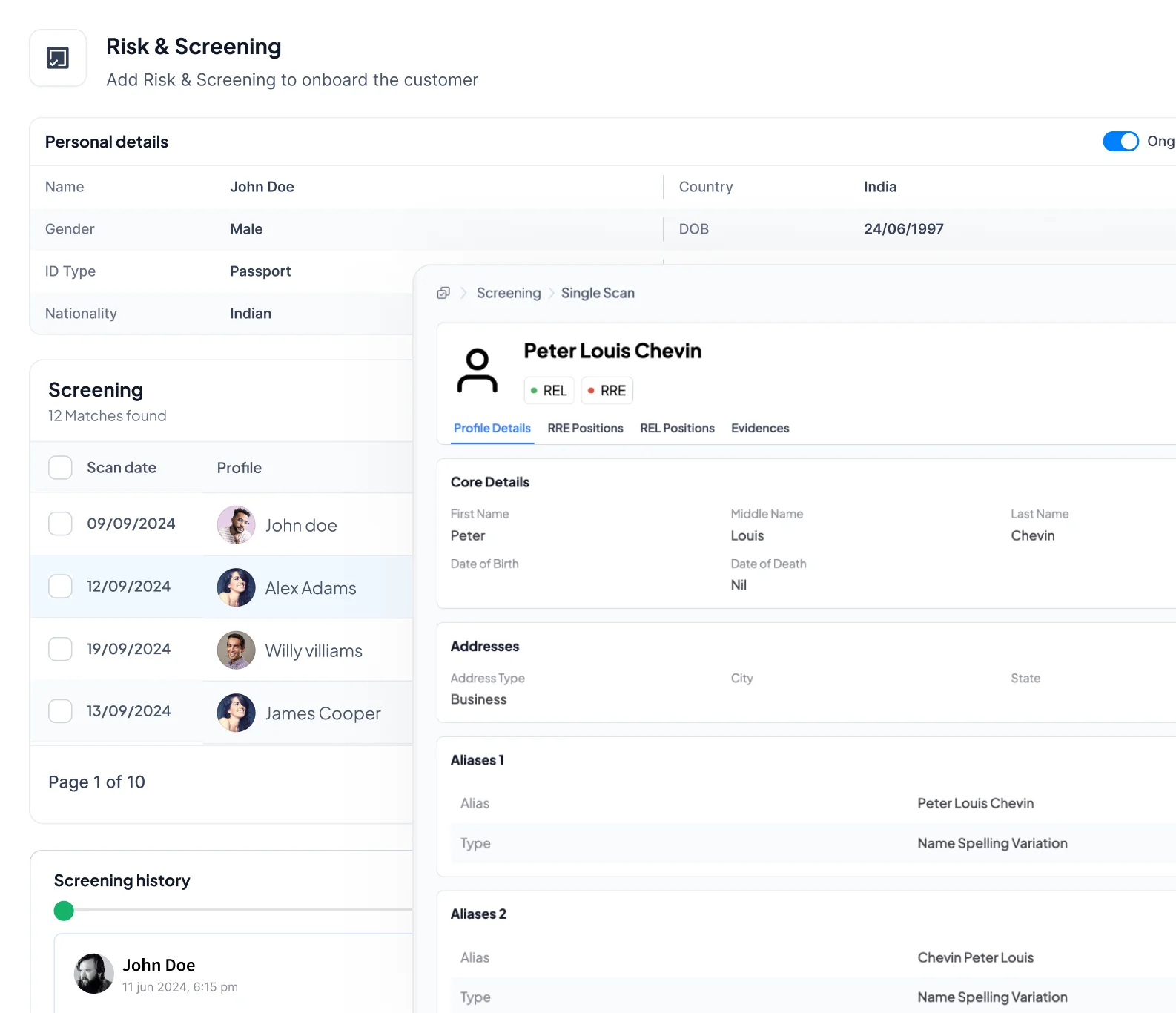

Integrated KYC6 Screening Engine with global sanctions, PEP, and adverse media coverage.

Identify and classify Tier 1, Tier 2, and Tier 3 PEPs.

Daily rescreening of the individuals against the updated watchlists.

Clear visibility of newly generated alerts against each customer.

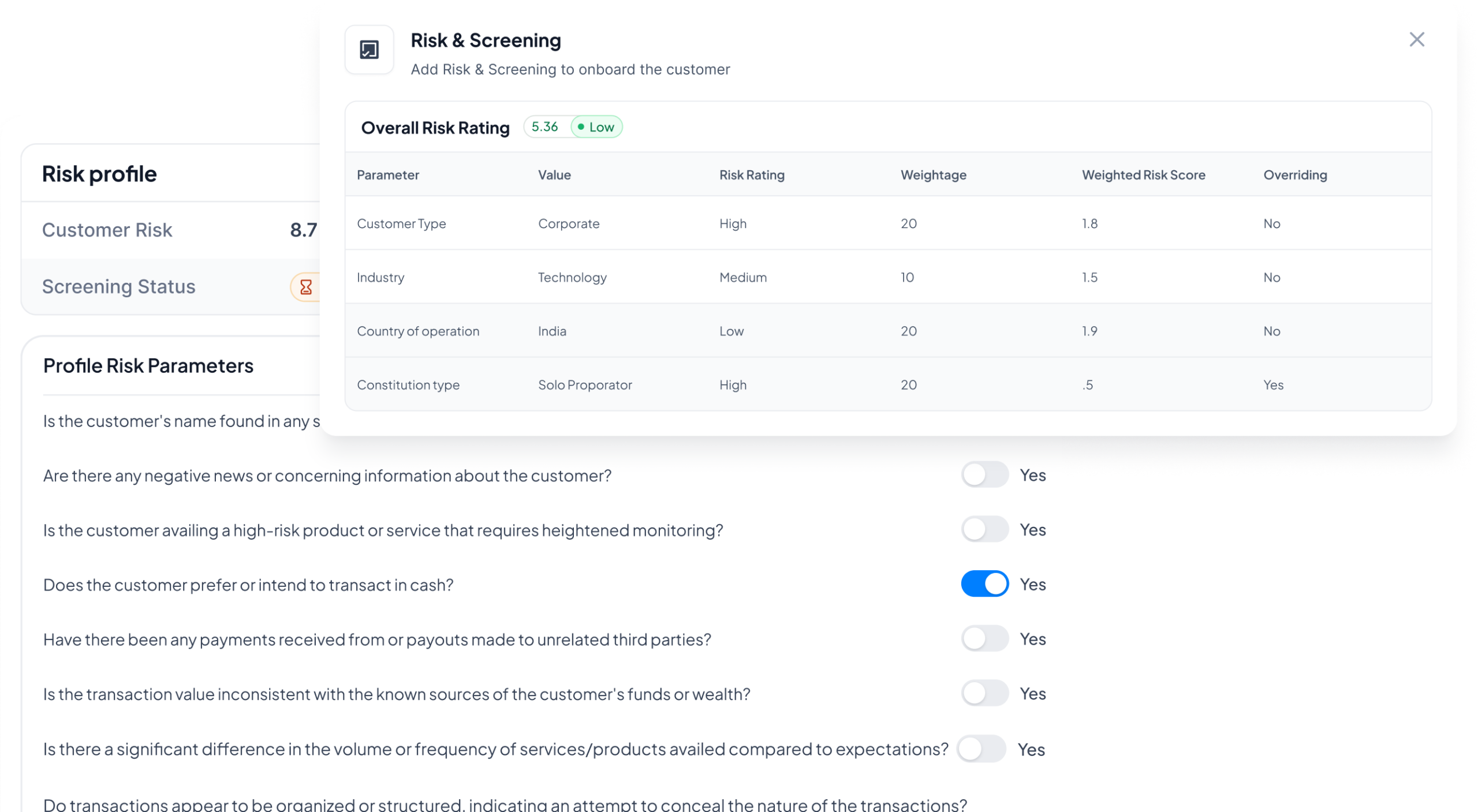

Manual risk assessments are error-prone and time-consuming. Citadel365 automates Customer Risk Assessment (CRA) procedures, turning hours of sorting into seconds of insight. We help identify onboarding and profile risks and make onboarding decisions in line with your risk appetite. Dive deeper?

CRA for individual and corporate customers.

Highly configurable risk scores and weights.

Risk profile tab featuring risk insights.

Identify and classify customers into various categories, like high-risk, medium-risk, and low-risk

Take Enhanced Due Diligence (EDD) measures for high-risk customers.

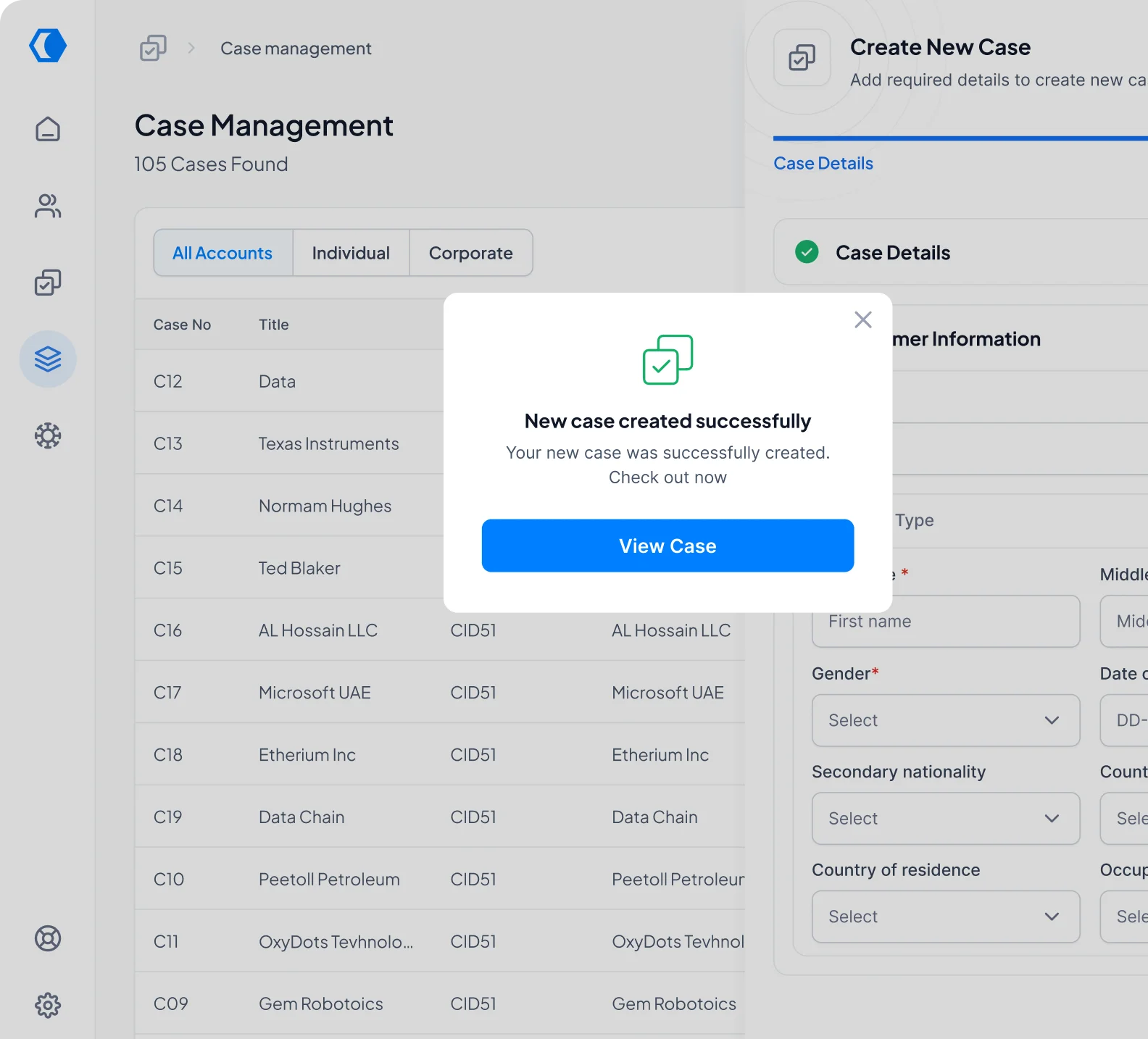

Compliance is all about sorting the wheat from the chaff. Citadel365 has a separate space for customers who are found suspicious to disambiguate them. We help you create a case and escalate it to the compliance team. So, what’s the extra edge?

Manual case creation for flagged customers and alerts.

Downloadable customer profiles for efficiency while reporting for regulatory submissions.

Risk-based case management

Complete audit trail for record-keeping

Separate lists for alerts, cases, and monitoring actions.

Dissolve Your AML Compliance Issues with the Right Tools.

Our purpose isn’t just to bridge you to AML compliance, but to help you stay compliant always. We help you with the right AML compliance tools that keep you from feeling the compliance journey like a ride on a rollercoaster of relentless tasks.

Compliance Directed

We automate your AML compliance.

Citadel365 accelerates onboarding, supports multi-channel data capture, and minimises human errors & lengthy processes.

Enhancing the Customer Experience.

Citadel365 streamlines manual onboarding procedures and helps you deliver a world-class customer experience, resulting in a loyal customer base and rapid business growth.

Risk, Revealed.

The combined processes help you figure out the ML/FT risks related to your business.

Citadel365 provides a 360° view of risks associated with customers for you to make headway with risk mitigation strategies.

Decisions Guided by Insights.

Citadel365 provides dashboards and reports and helps take a risk-based approach while onboarding customers.

Rules Followed, Processes Made Simpler.

Citadel365 ensures you stay compliant with simple steps.

We’re ready to answer your queries!

We provide ease to customer data collection, verification, screening checks, and risk assessments. Citadel minimises errors and time spent on performing compliance processes by ensuring automation at every step. Further, with a case management solution, we help organise and prioritise compliance cases with ease.

Citadel automates customer onboarding, screening, and risk assessment to accelerate your pace. The platform monitors and tracks every activity to generate alerts for expiry documents and critical updates that reduce manual tracking. Further, Citadel allows you to download customers and screen results reports in one click.

Yes, our AML platform is a SaaS product that facilitates scalability and flexibility. We offer cost-effective and modular solutions that fuel the growth of small businesses. Herewith, Citadel offers automation, end-to-end compliance, a centralised dashboard, and user-friendliness to simplify complex workflows, resulting in the best fit for large compliance teams.

You must choose AML software that is a cure for your compliance operations. Features include a single platform that eliminates the need for fragmented tools, instantly calculates risk scores, and provides real-time monitoring. Other attributes comprise supporting audit trails for record-keeping, having simple interfaces, ensuring data security, and meeting regulatory requirements. For your ease, Citadel cater to all.

Yes, Citadel automatically identifies customer status changes and potential matches from the screening engine for ongoing due diligence. The platform also performs daily rescreening with the updated data sources. Additionally, it performs ongoing monitoring that highlights alerts and makes them accessible for compliance officers to stay compliant.